Will the publication of GP net earnings really improve transparency?

The NHS Employers and the General Practitioners Committee of the BMA have announced changes to the GMS contract in England for 2015/16. In unprecedented plans to increase the transparency of practices, one of the main changes is the publication of GP earnings.

The changes came into force on April 2015 and it is now a contractual requirement for GMS practices to publish details of GPs’ net earnings on their practice website by 31 March 2016.

Alongside the mean figure, practices will be required to publish the number of full and part time GPs in the practice.

This includes:

- Income from NHS England, CCGs and local authorities for the provision of GP services that relate to the contract or which have been nationally determined.

- All earnings to be reported are pre-tax, National Insurance and employee pension contributions.

- For contractors the figures are net of practice expenses incurred.

This does not include:

- Income and costs related to premises, dispensing, private work, out of hours or other commitments

Additional transparency, or unnecessary compliance?

Scott Sanderson, healthcare partner and specialist GP accountant at Hawsons, said: “The changes to the GMS contract in regards to the publication of mean GP net earnings, and the plans to publish individual GP net earnings in 2016/17, aims to introduce a much more transparent system – similar to that of other public sector bodies – but is a move which has been a shock to many in the sector.”

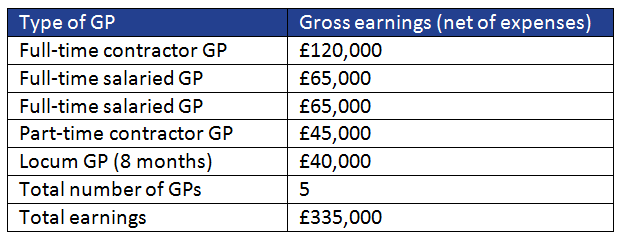

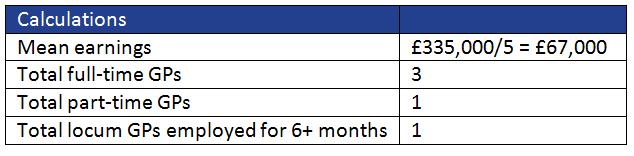

Speaking about what practices will have to do, Scott added: “The information must be published on the practice’s website by 31 March 2016, and must also be made available in hard copy on request. Although NHS England is yet to publish guidance on how mean net earnings should be calculated, they have acknowledged the potential difficulties in dis-aggregating income and expenditure lines in exact terms. The example below shows exactly what practices will have to do when publishing earnings, including the publication of the number of full and part-time GPs in the practice, as well as mean earnings.”

Example of calculation and publication wording for website

All GP practices are required to declare the mean earnings (e.g. average pay) for GPs working to deliver NHS services to patients at each practice. The average pay for GPs working in [inset practice name] in the last financial year was £67,000 before tax and NI. This calculation is for 3 full-time GPs, 1 part-time GP and 1 locum GP, who has worked in the practice for more than 6 months.

What does this mean for your practice?

Scott commented: “As you can see from the above example, the calculation mechanisms may actually further blur the real GP net earnings. The general viewpoint is that the mean GP earnings published will have a tendency to be much lower, as they may be heavily influenced by part-time contractor GPs and part-time salaried GPs within the practice. It is therefore extremely likely that, following a consultation in due course, the publication of individual GP net earnings will come into force in 2016/17.”

“The detailed and complex contract guidance, which sets out what income and expenditure to include and not to include, may also further inhibit the current process. Without proper guidance and further help from NHS England the figures published could be completely different from the actual mean GP earnings. In fact, as an example, if there were 10 calculations into the mean earnings for GPs working within a particular practice, it is likely each figure would be completely different. The process has set out to introduce a much more transparent system, but unfortunately looks too onerous to implement in practice.”

A potential consequence

Scott concludes: “Another consequence that may arise from this process, which has been overlooked by many, is the potential impact the publications may have on GPs themselves. In certain areas of the UK where GPs’ incomes are significantly lower, for one reason or another, there may be a decline in GPs wanting to work in that area or at specific practices, which would in turn have a considerable impact on the sustainability and succession plans of many practices.”

More from our GP practice experts

You can find all of our latest GP practice sector news and newsletters here.

If you are looking for advice in a particular area, please get in touch with your usual Hawsons contact.

Alternatively, we offer all new clients a free initial meeting to have a discussion about their own personal circumstances – find out more or book your free initial meeting here. We have offices in Sheffield, Doncaster and Northampton.

Scott Sanderson

Scott Sanderson began his career with Hawsons and trained as a Chartered Accountant, becoming a partner in 2015, specialising in the healthcare sector and small businesses. For more details and advice, please contact Scott on ss@hawsons.co.uk or 0114 266 7141.[/author_info]